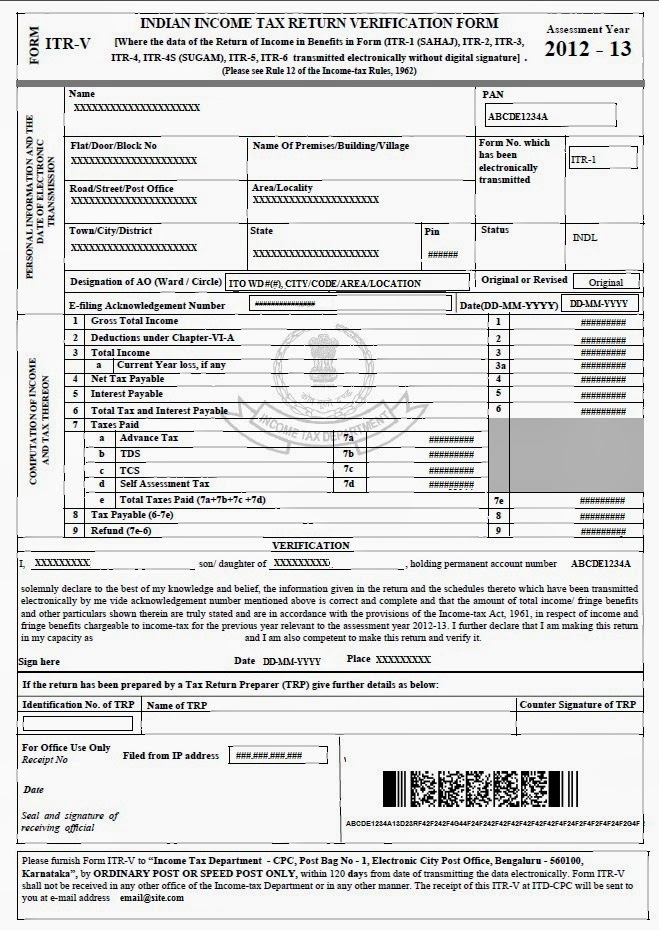

Select the option to e-verify the return as well. Choose ‘Upload XML’ for the assessment year, ITR form number, filing type, and submission mode.

You will be taken to the NSDL website.If you need to pay taxes, go to the “Taxes Paid and Verification” tab and select “e-pay Tax.” Once all of the required information has been entered, click the "calculate tax" button. Check the auto-filled information and fill in the blanks in the excel utility.By clicking on ‘Import from XML,’ you can import data from the pre-filled downloaded XML file into the Excel utility. Step 6: The Excel and XML utilities will be saved in the PC's downloads folder.Step 5: Save the XML file to your computer.Step 4: Select the applicable ITR Form based on the nature of income mentioned in the description box, and download it in Microsoft Excel format.Select the ITR Form Number for which the Excel utility was downloaded. Step 3: After you've logged in, go to ‘My Account’ and select ‘Download Pre-filled XML.’ Choose the Assessment Year for which a return is required.

Step 2: If you are a new user, click ‘Register.’ (To register, choose a user type, enter the required information, and validate the registration.) If you are an existing user, click the ‘Login’ button.Click on the ‘Register’ or ‘Login’ button on the income tax portal. Step 1: Go to the official income tax filing portal.

0 kommentar(er)

0 kommentar(er)